Crowdfunding is one of the popular ways to raise money. It has successfully helped many small businesses, entrepreneurs, artists, and innovators bring their dreams to life.

Though crowdfunding is a relatively new way for entrepreneurs to raise money, it is helpful for new entrepreneurs who don’t have much exposure to financial, professional, and network sources.

Let’s look at the world of crowdfunding, exploring its mechanics, different types, and popular platforms that have transformed countless ideas into reality.

Here’s what we’re going to cover:

- How Crowdfunding Works

- Pros and cons of raising money through crowdfunding

- Different types of crowdfunding

- Popular crowdfunding platforms

- Crowdfunding – Alternatives

Crowdfunding at a glance

At its core, crowdfunding is a method of raising small amounts of money through donations or investments from many people to finance a project or initiative. It’s an alternative to raising money through traditional financing channels like banks or venture capitalists.

Most beginners have this question – Is crowdfunding even legal?

Well, it depends!

The legal aspects of crowdfunding depend on your market. Most countries and regulating bodies accept crowdfunding as an alternative source of finance instrument. However, the regulations would vary from country to country. So we suggest you research your country’s regulations, rules, exemptions, and limitations regarding the fund amounts, investments, and type of investors.

You should also keep in mind the data, financial reporting structure, security, and transactional requirements of crowdfunding platforms that you want to run campaigns on.

How Crowdfunding Works

Let’s say you have an interesting business idea or a project in mind. It could be creating a new application, selling unique and quirky t-shirts, or making a movie. You may not have sufficient funds to bring your ideas to life.

That’s when you can turn to crowdfunding.

To give you a broad view, this is how crowdfunding works:

Choose a Platform:

You go to a crowdfunding website like Kickstarter, Indiegogo, GoFundMe, etc. These platforms provide you the opportunity and venue to showcase your idea and ask for support.

Pitching Your Idea:

Start by creating a page that explains your project in detail. You can talk about what you want to do, why it’s important, and how much money you need to make it happen. You might even include videos, images, and other things to get people excited.

Set the Goal:

You set a target amount of money you need to raise. This is the goal you want to reach to make your idea a reality. It covers everything from production costs to marketing and more.

Incentives:

You can offer rewards or incentives to encourage people to contribute to your project. These could be things like early access to your product, a shoutout on your project’s website, or even a special version of your creation.

Spread the Word:

You share your crowdfunding page with your friends, family, social media followers, and anyone else who might be interested. The more people see it, the more likely they are to give.

Contributions:

People who like your idea can contribute money through the crowdfunding platform. They can usually choose different amounts to give, depending on what they can afford.

All or Nothing:

Some crowdfunding campaigns work on an “all or nothing” basis. This means you don’t get any of the money if you don’t reach your funding goal by a certain deadline. This encourages people to really rally behind your project.

Reach Your Goal:

If your campaign is successful and you reach your funding goal, the platform will collect the money from all the people who pledged. You can then use this money to make your project happen.

Make it Happen:

With the funds you’ve collected, you can start working on your idea. You can create your gadget, make your movie, or start your charity project, using the money for all the things you’ve promised.

Deliver Rewards:

Once your project is complete, you deliver the rewards or incentives to the people who supported you. This could mean sending out products, organizing special events, or whatever you promised.

So, crowdfunding is a way for lots of people to chip in a little bit of money to help bring creative or innovative ideas to life.

This is a glimpse of some of the technology-related crowdfunding projects on one crowdfunding website – Kickstarter.

Pros and cons of raising money through crowdfunding

Just like any other way of raising funds, crowdfunding has its set of advantages and disadvantages.

Key advantages of crowdfunding:

- It is a good way to test your business idea

- You can avoid other forms of high-interest loans that could range from 6% – 12%

- You don’t need a credit score to get funding

- You can save time in raising capital

- You can generate initial awareness and market your business idea

- You can potentially build an audience of early adopters and brand advocates

- You can find ways to connect with potential customers and gather feedback on the product or service

- Upfront costs to run the crowdfunding campaign are usually low

Main disadvantages of crowdfunding:

- Based on research findings, a mere 22.4% of crowdfunding campaigns effectively achieve their investment objectives. So chances are high that you can miss reaching your targets and end up walking away with no funds.

- If you don’t know yet, there’s no such thing called “free money.” Almost all crowdfunding platforms would take a percentage of the total amount you raised as their fee.

- Through these platforms, you risk exposing your idea to thousands of people who could imitate or copy your project.

- Crowdfunding platforms are open to anyone. So you expose your ideas to criticism and negativity, which could therefore affect your public reputation

- Successfully funded projects may encounter challenges when fulfilling rewards and meeting backer expectations. It could be due to production delays, unforeseen costs, or other obstacles that can lead to dissatisfaction among backers and damage the project’s reputation.

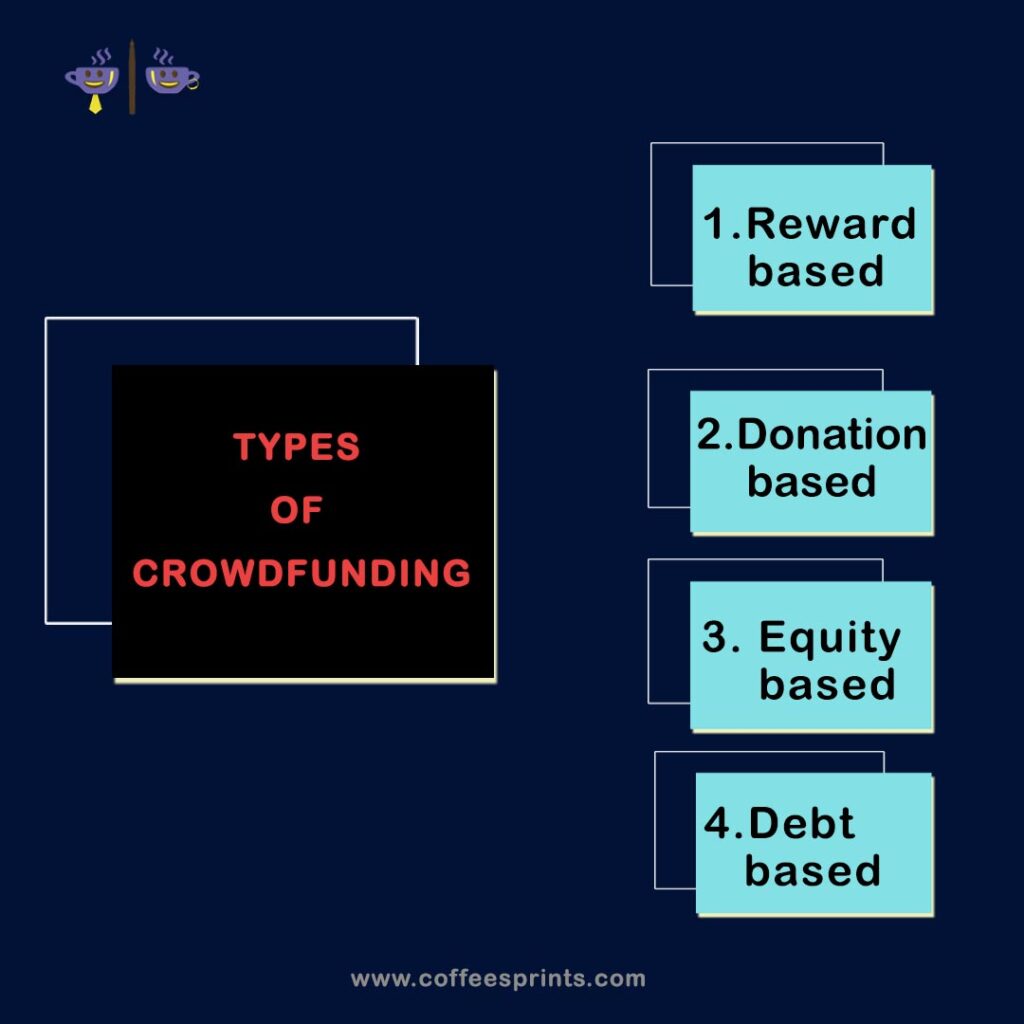

What are the different types of crowdfunding?

You can get crowdfunding for your business in 4 ways.

- Reward-based crowdfunding

- Donation-based crowdfunding

- Equity-based crowdfunding

- Debt-based crowdfunding

Let’s go over them one by one.

Reward-based crowdfunding

This is the most common type of crowdfunding, where backers pledge money in exchange for non-monetary rewards or perks. These rewards could be early access to the product, exclusive merchandise, or special acknowledgments.

Donation-based crowdfunding

In donation-based crowdfunding, backers contribute without expecting any material returns. They are driven by a belief in the project’s cause or mission, making it popular for charitable, social, or humanitarian initiatives.

Equity-based crowdfunding

Unlike reward-based crowdfunding, equity-based crowdfunding involves backers receiving shares or ownership in the venture. This type is prevalent in the startup and business world, allowing investors to become shareholders and potentially benefit from the project’s future success.

Debt-based crowdfunding

Also known as peer-to-peer lending or crowdlending, Debt-based crowdfunding enables individuals or businesses to borrow money from a crowd of lenders. Borrowers repay the loan with interest over time.

Popular crowdfunding platforms you should know about

Kickstarter

One of the most well-known reward-based crowdfunding platforms, Kickstarter has helped launch thousands of creative projects, including tech gadgets, films, games, and artistic endeavors.

It supports innovators, artists, and dreamers’ businesses and projects and helps them pitch ideas and ask for support from a global community. Backers pledge money in exchange for rewards, ranging from early access to the finished product to exclusive experiences. If the project reaches its funding goal by a set deadline, the creator receives the pledged funds to turn their vision into reality. Kickstarter encourages collaboration, innovation, and the power of collective support to make amazing projects happen.

Indiegogo

Similar to Kickstarter, Indiegogo is another popular reward-based crowdfunding platform with a global reach, supporting a wide range of projects.

Indiegogo is an innovative crowdfunding platform that empowers creators to bring their ideas to life. It offers a space for creators to showcase their projects and seek support from a global audience.

Indiegogo stands out with its flexible funding model, allowing creators to keep the funds raised even if the initial goal isn’t met. This enables a broader range of projects to receive backing. The platform also offers both rewards-based and equity crowdfunding options, providing creators with diverse ways to engage backers. Indiegogo’s inclusive approach and funding choices make it a unique hub for turning visions into reality.

SeedInvest

SeedInvest is an innovative crowdfunding platform that specializes in equity crowdfunding for startups and small businesses. A platform where investors can discover and support promising early-stage companies.

Unlike traditional crowdfunding, SeedInvest allows backers to invest in exchange for company equity, essentially becoming shareholders. This platform offers a curated selection of investment opportunities, ensuring that only carefully vetted businesses are showcased.

SeedInvest’s focus on equity-based crowdfunding and its dedication to connecting investors with promising startups make it a distinctive platform in the crowdfunding landscape.

GoFundMe

A donation-based crowdfunding platform, GoFundMe is widely used for charitable causes, personal emergencies, and medical expenses. It is a venue where people can ask for financial help from friends, family, and even strangers. Unlike some platforms, GoFundMe focuses on personal campaigns, offering a space for medical bills, education expenses, community projects, and more. It’s unique for its emotional connections, enabling people to make a difference in each other’s lives by offering financial assistance and spreading hope.

A few alternatives to crowdfunding:

Let’s quickly explore a few potential ways to raise funds for your business.

If you want an in-depth guide on raising money for your business, here’s the article you need. It talks about 12 different ways you can raise funds for your next business venture.

Bootstrapping

Bootstrapping involves funding a project using personal savings, revenue generated from initial sales, or support from friends and family. While it may require you to invest more of your own resources, it provides full control over the project and avoids the complexities of running a crowdfunding campaign.

Angel Investors and Venture Capital

If your startup or business has high growth potential, seeking investment from angel investors or venture capitalists might be a viable option. Angel investors are individuals who provide capital in exchange for equity, while venture capitalists are firms that invest in startups in return for equity stakes. These investors can bring funds, expertise, and networks to help the project grow.

Small Business Loans

You can also fund your projects through traditional small business loans from banks or credit unions. While this option involves debt, you can maintain complete ownership and control over the venture.

Grants and Government Funding

Depending on the nature of the project, grants or government funding programs might be available to support specific industries, research, or social initiatives. These sources of funding often come with specific requirements and eligibility criteria.

Pre-sales and Pre-orders

You can generate revenue and validate your product by offering pre-sales or pre-orders to potential customers. With this approach, you can fund initial production and gauge market interest without going through a full-scale crowdfunding campaign.

To sum it up!

Crowdfunding is a powerful tool that has transformed the way individuals and businesses access capital and turn their ideas into reality. It has democratized fundraising, empowering innovators and creators to turn their ideas into reality with the collective support of backers worldwide. Whether you’re an entrepreneur with a groundbreaking invention or an artist seeking to produce your next masterpiece, crowdfunding opens the door to realizing your dreams and connecting with a supportive community eager to see you succeed.

Remember, successful crowdfunding campaigns require thoughtful planning, a compelling pitch, and effective engagement with your backers. Engaging with your crowdfunding community will help you cultivate a loyal base of supporters who believe in your vision. So, embrace the power of crowdfunding, and let your ideas take flight with the backing of the crowd.

2 thoughts on “Crowdfunding For Your Next Big Idea – Examples, Types, and Alternatives”

Your website is very useful. Thanks for sharing.

Informative article, just what I was looking for.