The success of a startup depends on how well you manage your finances.

Around 50% of businesses fail today for various reasons, and finances are one of them.

Many entrepreneurs fund their new companies on their own. But there are more options available.

And funding your startup can also depend on the type of business.

Raising capital for your startup is never easy. It takes longer than anticipated.

We know the nitty-gritty of finances could be the last thing you want to think about while managing your business. But letting them take a back seat isn’t a good idea either.

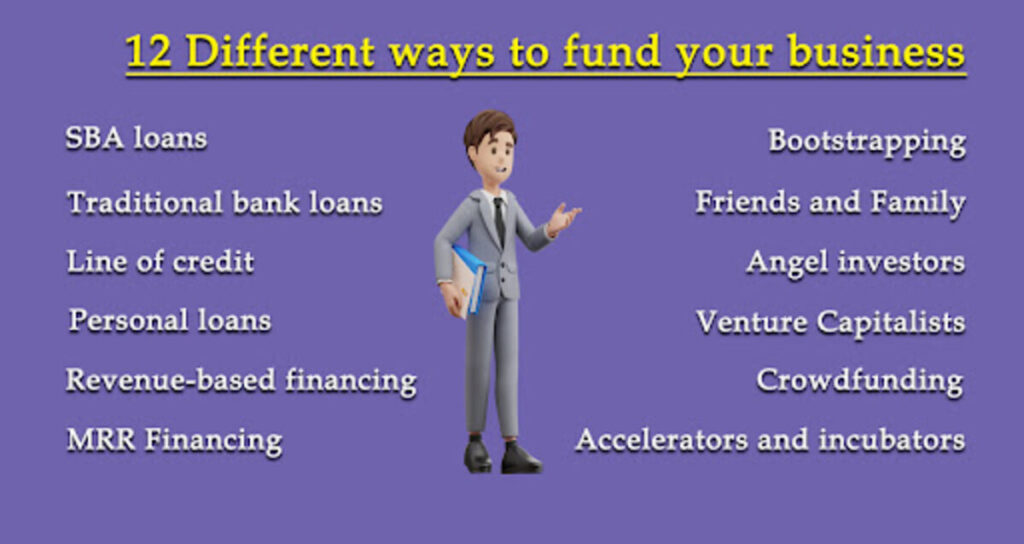

Raising money is one of the exciting and challenging times for a startup owner. So we’ll show you 12 ways to raise funds for your startup and everything else to help you get started.

Here’s a quick peek into the topic.

- Equity vs Debt – Two types to fund your business

- 12 ways to raise funds for startups

- Bootstrapping

- Friends and Family

- Angel investors

- Venture capitalists (VC)

- Crowdfunding

- Accelerators and incubators

- Small Business Administration (SBA) Loans

- Traditional bank loans

- Business lines of credit

- Personal loans

- Revenue-based financing (RBF)

- Monthly Recurring Revenue (MRR)

If you’re familiar with equity and debt-based funding for your startup and want to learn about the actual ways to get funds, skip to this part.

Equity vs Debt – Two types to fund your business

Before we get into the details, you should know that you can fund your business in two ways.

Equity-based Funding

In this funding, You raise capital for your startup by selling ownership in the company. Instead of taking debt, you offer investors a share of the company in exchange for their investment.

This means that the investor becomes a partial owner of the company and is entitled to a portion of the company’s future profits.

This equity-based financing can come from a variety of sources like self-funding, angel investors, venture capitalists, and even crowdfunding platforms. You offer equity in exchange for the investment, which depends on a number of factors, including the size of the investment, the stage of the company’s growth, and the investor’s risk tolerance.

One useful aspect of this equity-based financing is that you don’t have to make regular interest payments. It’s especially helpful in the early stages of your startup growth since cash flow could be tight during this period.

Additionally, when investors hold equity in the company, they would also want the business to succeed compared to those who lent money (in debt-based financing). This leads to active support and better contributions to the business growth beyond financial interests.

However, equity-based financing also means that you as the owner will have to give up some control over the company and share decision-making power with the investors. So we suggest you carefully assess your options and align them with your long-term business goals for success.

Debt-based funding

Let’s say you’re a startup looking to raise money through debt-based financing. This means you borrow money from a lender, and you have to pay it back with interest over time.

Debt-based financing can take many forms, such as bank loans, lines of credit, or even credit cards. When you take out a loan or line of credit, you’re given a lump sum of money that you can use to fund your startup. You’ll have to pay back the loan over time, usually with interest.

For example, let’s say you take out a $50,000 bank loan to fund your startup. The bank charges you 7% interest per year, and you need to pay back the loan over five years. That means you’ll have to pay back $11,122 in interest over the life of the loan, in addition to the $50,000 principal.

Debt-based financing can be a good option for startups that have a solid plan for generating revenue and can reasonably predict their ability to pay back the loan over time. It is also a good way to build up a credit history for your startup, which can make it easier to get financing in the future.

On the other hand, debt-based financing also means taking on a financial obligation that you’ll need to meet, regardless of your startup’s success. If your business doesn’t generate enough revenue to pay back the loan, it could put your startup at risk. Additionally, lenders often ask for collateral, such as property or equipment, to secure the loan, which can be a significant risk for startups that don’t have a lot of assets, to begin with.

12 ways to raise funds for startups

Now that we have covered the main ways you can raise money, let’s look at the common sources to avail funding for your startups

Bootstrapping your business

Bootstrapping is a good way to build your business from the ground up with limited resources, especially when you are just starting out. In this model, you as a business owner will rely on your personal finances.

Let’s say you’re starting a business and you don’t have a lot of money to invest in it. It means you’re relying on your own savings, revenue from the business, and creative solutions to keep the business going.

A few successful businesses that started with bootstrapping before getting other funding include Dell Computers, Meta (META), Coca-Cola, Apple, Microsoft, and others.

One way to bootstrap is to keep your expenses low. You can probably work from home, use open-source software for your tech needs, or even do tasks yourself that you might have otherwise outsourced.

By keeping your costs low, you can conserve your cash and other resources and redirect the investments back into the business.

Another strategy you can succeed with Bootstrap is to generate revenue early on. This means getting your product or service to market quickly and finding customers who are willing to pay for it. By generating revenue early on, you can reinvest that money back into the business, instead of having to rely on external funding.

You should be resourceful and creative with the available resources in bootstrapping. For example, instead of paying for advertising, you can leverage organic ways like blogs, social media, and other free channels to get your message out there.

Advantages and disadvantages of bootstrapping

Here are a few advantages and disadvantages of bootstrapping that you should keep in mind.

A few advantages include:

- You have more control over your business decisions.

- You learn to be lean and efficient with resources.

- You can be agile with your business and move quickly.

A few disadvantages include:

- You need to work with limited resources so it can be challenging to scale your business

- Money is a crucial factor in any business. Without additional funds, it can be harder to take advantage of new opportunities and grow your business.

- Bootstrapping can be risky. When you invest from your own personal savings and if the business fails, you could lose everything you’ve invested – time, money, and effort.

Friends and Family

Seeking money from friends and family is considered the most common option for many startup founders.

In fact, friends and family funding contribute to tens of billions of money per year (source).

There are three common ways how friends and family funding work:

Gifts: They provide you with the money for the startup. End of the story. Have a formal agreement in place, though.

Loans: They lend you money for your business. You need to repay them at equal intervals or with a repayment schedule. You can use peer-to-peer lending or an agreement.

Equity: As discussed above, investors, in this case, family and friends become your business partners or shareholders. We suggest you involve a lawyer to draft a formal agreement so everyone is on the same page. Also, do not dilute the shares early on as it can be hard for you to seek formal investments later for your business.

Family and friends’ funding can also be a good source for long-term investments. This group is motivated by loyalty and support than by strict return on investment since these are usually the close circle of people with a strong affinity towards you or your business.

“Combining money and financial risks with personal relations can be risky.”

Given all these advantages, it’s easy to take investments from friends and family for granted. But combining financial transactions with personal relations can be a risky endeavor. So, you should document all the investments and clarify the risks involved to your people.

Angel investors

Angel investors are individuals who invest their own money into early-stage businesses in exchange for equity (ownership) in the company. They are often successful entrepreneurs or business people who have made their own fortune and want to help other entrepreneurs get started.

In return for their investment, angel investors receive equity in the company. This means they own a percentage of the company and are entitled to a share of the profits if the company does well. Typically, they would want a share of 10% – 25% of your company in exchange for funds. It means you may lose control as they may have a say in how the company is run and take a seat on the board of directors.

Angel investors typically invest in companies that are too early or too risky for traditional venture capital firms to invest in. They fund the startup when they see some potential for significant growth and a competitive edge.

They can provide you with capital, mentorship, and connections to help the company grow. Angel investors also look for companies with a talented and dedicated management team that can execute their vision.

Though angel investing can be risky when startups fail, it can be rewarding at times. For this reason, angel investors typically invest in a portfolio of companies, rather than just one, to spread their risk and increase their chances of success.

A few ways to find angel investors for your startup are:

- AngelList platform

- Networking events

- Angel investment network

- Personal network

How to decide if angel investing is the right way to fund your startup

Consider the following factors when deciding if an angel investor is right for your startup business:

- Stage of your business

Angel investors are typically interested in investing in early-stage companies that have high growth potential. If your business is still in the ideation or development phase, it may not be the right time to seek angel investment.

- Industry fit

Finding an angel investor with experience or expertise in your industry is important. They will be able to provide valuable insights and connections that can help your business succeed.

- Investment amount

Angel investors typically invest anywhere from $25,000 to $500,000, although some may invest more or less. You should determine how much capital you need to reach your next milestone and find an investor who can provide that amount.

- Alignment of goals

It’s important to find an angel investor whose goals align with yours. For example, if you want to build a sustainable business that prioritizes social impact, you should look for an investor who shares similar values.

- Due diligence

Before accepting investments from an angel investor, you should conduct due diligence on them. This includes researching their track record, speaking with their previous investments, and checking their references.

- Equity and ownership

When accepting investment from an angel investor, you will be giving up a percentage of ownership in your company. It’s important to understand the terms of the investment, including the amount of equity being offered and any potential restrictions on how you can run your business.

- Exit strategy

Angel investors will want to know how they will get a return on their investment. You should have a clear exit strategy in place. It could be an acquisition or initial public offering (IPO), demonstrating how investors can realize a return on their investment.

4. Venture capitalists (VC)

Venture capital (VC) funding is a type of financing that consists of a group of investors and is called a venture capital firm. They provide capital investments to startups that have the potential to scale rapidly and become large companies. They invest in the company for an exchange of a minor equity stake. They look for companies that are poised to generate high ROI (return on investment) in the upcoming years.

The process of obtaining VC funding typically involves several stages.

Sure, here are some simple steps on how the venture capital funding process works for a startup:

- Pitch your business idea to a venture capital firm

- If interested, the VC firm conducts due diligence on your company

- Negotiate terms of investment, such as the amount of equity being offered and the amount of funding

- Receive capital from the VC firm

- The VC firm becomes part owner of the company and provides strategic advice and guidance

- They hold onto the equity for several years with the goal of eventually selling it for a profit

Remember that while venture capital funding can provide you with the capital needed to grow, it’s not always the best option for every startup.

VC firms typically invest in companies with high growth potential and unique business models. They also can provide strategic guidance and management advice for the company. This includes introducing you to potential clients, partners, and industry experts.

However, VC funding can come with significant pressure to grow quickly and meet high revenue targets. They would also have a say in the strategic direction of the company.

VC funding is suitable for entrepreneurs who aim big but don’t need full control of the company as it grows. So keep these aspects in mind before you consider whether venture capital funding is the right choice for your business.

5. Crowdfunding

This involves raising small amounts of money from a large number of people, often through online platforms. Crowdfunding leverages a vast network of people through crowdfunding websites, social media, and other relevant platforms to bring entrepreneurs and investors to one place.

These crowdfunding platforms provide access between fundraisers and the crowd. These platforms get their revenue as a small fee from the funds raised.

Kickstarter, GoFundMe, Indiegogo, Fundly, Patreon, and LendingClub are a few popular crowdfunding platforms.

Why crowdfunding could be a good option?

This can be a great way to get your business off the ground, and here’s why:

- You get access to a large pool of potential investors who are passionate about your idea and willing to invest in your business.

- If you’re able to successfully crowdfund your startup, it can be a validation of your business idea. It shows that there is demand for your product or service and can be a great way to get feedback from potential customers.

- Crowdfunding can be cost-effective to raise capital for your startup. Unlike traditional funding methods, such as venture capital or angel investors, crowdfunding typically involves lower fees and less equity dilution.

- This one is a no-brainer. Crowdfunding campaigns can help to increase your visibility and get your business in front of a larger audience. This can be a great way to market your product or service and attract potential customers.

- Crowdfunding investors are often passionate about the projects they invest in and can become advocates for your business. This can help to build a community around your brand and generate buzz for your startup.

However, it’s important to remember that crowdfunding isn’t a guaranteed source of funding. You’ll need to put in the time and effort to create a compelling pitch, build a strong community around your brand, and promote your campaign effectively.

When crowdfunding is not the right fit for you?

While crowdfunding can be a great way for startups to raise capital, it’s not always the right option for every business. Here are a few scenarios in which crowdfunding might not be the best fit:

- Lack of market interest: If there is little to no interest in your product or service, it may be difficult to attract investors through crowdfunding. In order to successfully crowdfund your startup, you’ll need to have a compelling business idea that resonates with potential investors.

- Limited funding needs: While you can raise a few thousand dollars to get your business off the ground, it may not be the best option if you require significant capital to get started. In such cases, traditional funding methods such as venture capital or angel investors may be a better fit.

- Time constraints: Crowdfunding campaigns can be time-consuming and require a significant amount of effort to create a compelling pitch, build a strong community around your brand, and promote your campaign effectively. If you’re on a tight timeline and need to raise capital quickly, this wouldn’t be the best option.

- Complex business models: Crowdfunding investors typically expect a clear and straightforward business model. If your business model is complex or difficult to understand, it may be difficult to attract investors through crowdfunding.

- Legal and regulatory requirements: Crowdfunding is subject to a variety of legal and regulatory requirements, which can vary depending on the platform you use and the type of crowdfunding you pursue. If you’re not familiar with these requirements or don’t have the resources to navigate them effectively, crowdfunding may not be the best option for your startup.

Now that you understood how crowdfunding works, we suggest you carefully consider the potential benefits and drawbacks before pursuing this funding method.

6. Accelerators and incubators

For early-stage startups, accelerators and incubators provide decent options to grow their businesses. These organizations provide funding, mentorship, and other resources to startups in exchange for equity.

While the terms “accelerators” and “incubators” may sound similar among startup hubs, there are significant differences in terms of how they work.

Accelerator

Accelerator programs generally have a specific timeframe in which the companies operate. The program typically starts with an application. The top programs can be competitive, and they usually choose limited ones among a pool of applications.

They spend from a few weeks to a few months working with mentors to build the business.

Y Combinator and Brandery are a few known accelerators in the industry.

If the startup is in the early stage, they get a small seed investment and access to a large network, in exchange for a small equity stake. The mentor groups would be large and include startup executives, venture capitalists, experts, and others.

Incubators

Incubators can be a platform or a team of experts that help startups with mentoring, guidance, or office spaces as well as some funding. Incubators aim to provide necessary assistance to startups.

Youngstown Business Incubator of Ohio, DMZ of Canada, and Fintech Innovation Lab are a few examples of Incubators.

If you are an early-stage bootstrapped startup, incubators can be helpful. However, if you have already raised an angel round or Series A funding, incubators wouldn’t be an ideal fit. However, some startups even after being funded would continue to be part of incubators after they derive value.

If you’re looking to scale your business, an incubator is not the ideal option. However, it is suited to foster and support your business.

Incubators often play an intrinsic part in the startup ecosystem. They help you develop as an entrepreneur and business owner. It is also helpful for young entrepreneurs and professionals who are starting out.

7. Small Business Administration (SBA) Loans

The SBA offers a variety of loan programs designed to help small businesses access affordable financing. These loans are typically backed by the government and may have lower interest rates and more flexible terms than traditional bank loans.

The downside?

Some banks are risky as they may have limited operating histories, assets, and unpredictable cash flows. On the other hand, some SBA loan terms and conditions could change with the changes in government policies or regulations. This, in turn, can impact the borrower’s ability to repay the loan.

Some SBA loans also demand collateral like personal assets or real estate, which can be risky if you cannot repay the loan. So carefully evaluate your financial needs before applying for an SBA loan.

8. Traditional bank loans

These are common types of debt financing that offer secured loans with some collateral like equipment, real estate, etc. They charge fixed interest and come with a repayment schedule.

9. Business lines of credit

A business line of credit is a type of financing that provides you with access to a set amount of credit that you can draw on as needed. You only pay interest on the amount you borrow, making it a flexible option for managing cash flow.

10. Personal loans

In some cases, the founders of a startup may be able to obtain personal loans to finance their business. These loans are typically based on the creditworthiness of the individual rather than the business itself and may have higher interest rates than other types of financing.

While personal loans can be a viable option for startup funding, there are some potential drawbacks as well. Personal loans typically have higher interest rates than other types of financing, such as SBA loans. In addition, the borrower is personally responsible for repaying the loan, which means their personal credit score and financial stability could be at risk if they are unable to repay the loan.

11. Revenue-based financing (RBF)

This Revenue-based financing has become increasingly popular among startups these days. It provides a flexible and less risky alternative to traditional equity-based financing.

The lender or the investor analyzes the revenue and financial history of the startup. Once both parties agree, the amount will be disbursed. Instead of fixed repayments, the loan will be repaid as a percentage of the startup’s revenue over time.

In revenue-based financing, the lenders would charge higher interest rates to compensate for the risks they are taking on.

If you want to aim for this type of financing, you should ensure you have a solid revenue plan in place.

12. Monthly Recurring Revenue (MRR)

This is another debt financing option that’s popular among SaaS companies. Loans are disbursed based on the monthly revenue of the company. Since the cash flow is easier to manage, it avoids the burden during repayments. However, you should keep in mind that this model can be expensive compared to other financing options.

In general, you don’t have to give up equity in debt-based financing models.

Next steps

If you want to scale your business quickly, you don’t want to limit yourself and would require outside resources. While you can find a plethora of debt and equity funding options available for your startup, as a responsible business owner, try asking the right financial questions to manage your business the apt way.

2 thoughts on “12 Ways to Raise Funds for Your Startup Business in Record Time”