Unlike building your own business from scratch, buying an existing business can lead to profits quickly.

But you need to get your basics right.

This article helps you with the steps to find and buy a business. Let’s get started!

Here’s what we’ll cover.

- Why you should consider buying a business

- Three ways to buy a business

- How to buy a business – Your ultimate checklist

- Buying an existing business without money

- Advantages and disadvantages of purchasing an existing business

Why you should buy an existing business

There are several perks when you buy an existing business. Here are a few of them.

Revenue streams and cash flow

The business you’re buying already has a track record of making money. It’s not some wild guess or a shot in the dark like when you start from scratch.

Think about it like this: you’re walking into a ready-made money-making machine. The business has already been churning out sales and bringing in customers, so you don’t have to start from square one to make some money. You can take a look at their financial records and see how much dough they’ve been raking in. It gives you a sense of security and helps you make more accurate predictions about the business’s future performance.

And here’s the best part: since the business already has a customer base, you don’t have to go out there and hustle like crazy to find customers from scratch. You’re stepping into a game where people already know and trust the brand. That means you have a better chance of keeping those existing customers and even attracting new ones who are familiar with the business. It’s like having a head start in the race, where others are still stretching their legs at the starting line.

Existing customer base

This is an extension of the previous point. A built-in customer base is a huge plus for a business.

When you already buy an existing business, you do not have to find customers yourself. Since the business has been in place for a while now, customers know their products and the penetration into the market gets easier.

Besides, it’s easy for you to benefit from a loyal customer base, and your customer acquisition costs wouldn’t be as higher compared to building a startup from scratch.

To capitalize on the current customer base, all you need to do is add a fresh and unique perspective and increase sales and profits.

Finding networks and connections is easier

Networking and the right relationships can quickly help you transform your business to the next level.

If the business you’re buying has likely built relationships with suppliers, vendors, and maybe even manufacturers over the years, they give you an added advantage in the industry.

For instance, when you take over, the existing supply chain connections can help you get your hands on the goods and materials you need to run the business smoothly. You won’t have to waste time and energy searching for reliable suppliers or negotiating new deals. Instead, you can rely on the established connections and keep the flow of goods coming in without missing a beat.

And let’s not forget the power of networking. Through the existing business, you’ll have the opportunity to tap into industry networks and connect with other players in the market. These connections can open doors to new opportunities, partnerships, and collaborations. It’s like expanding your social circle but in the business world.

Of course, it’s not all rainbows and unicorns. You still need to assess those existing supply chain connections and relationships to make sure they’re solid and beneficial. You want to avoid any hidden issues or dependencies that might cause problems down the line. So, a bit of due diligence and evaluation is necessary to make sure you’re stepping into a web of helpful connections rather than a tangled mess.

Access to the Trained Workforce

An efficient workforce is an important asset to a business.

When you acquire an existing business, you often gain access to an experienced team of employees who are already familiar with the business operations. This can save you the time and effort of hiring and training new employees, allowing for a smoother transition and continuity of operations.

Higher chances of success

More than 80% of businesses fail in their first year. If a business survives its first year, it’s likely to succeed. Also, when a business worked well for the first five years, chances are that the original founders did something right with their business.

Once you do initial verifications and checks, you’re increasing your chances of success with that specific business.

Three ways to buy a business

Sure, building your own business from scratch can be rewarding, and the experience is invaluable. But it takes a decent amount of time to develop the business plan, find funds, and the risk involved.

If you’re not inheriting a family-owned business, or wouldn’t want to start from scratch, here are three options for buying a business.

You can buy out an existing business

This is probably the hardest way to get into a business, but it offers potential benefits to the entrepreneur. It can be tough to start from scratch as it consumes a lot of time, effort, and money until you bring it up to speed.

You often need to be a self-starter and learn and do things that you’re not uncomfortable with, so it involves a steep learning curve. In this model, generating revenue and finding potential customers is difficult.

You can buy a franchise

When you buy a business with some history, you benefit from the existing customer base, branding, and workforce.

The key here is to know the business and industry you’re going to purchase. In this case, the buying process can be more time-consuming than you expect, but you also get the independence to expand and make changes to the business once you buy it.

We’d discuss more about it in a bit.

You could buy a part of an existing business

Buying a franchise is one of the safest ways to start a business, but it’s not a cakewalk though. You must pay a licensing fee to run the business under the brand and use its suppliers, products, systems, and trademarks.

When you buy the right franchise, you benefit from its pre-existing:

- Branding,

- Organizational structure,

- Operations,

- Marketing activities, etc.

Before you decide, carefully assess your goals with the business, expertise and skillset, and financing options. Analyze your willingness to commit and the costs involved before diving head-first.

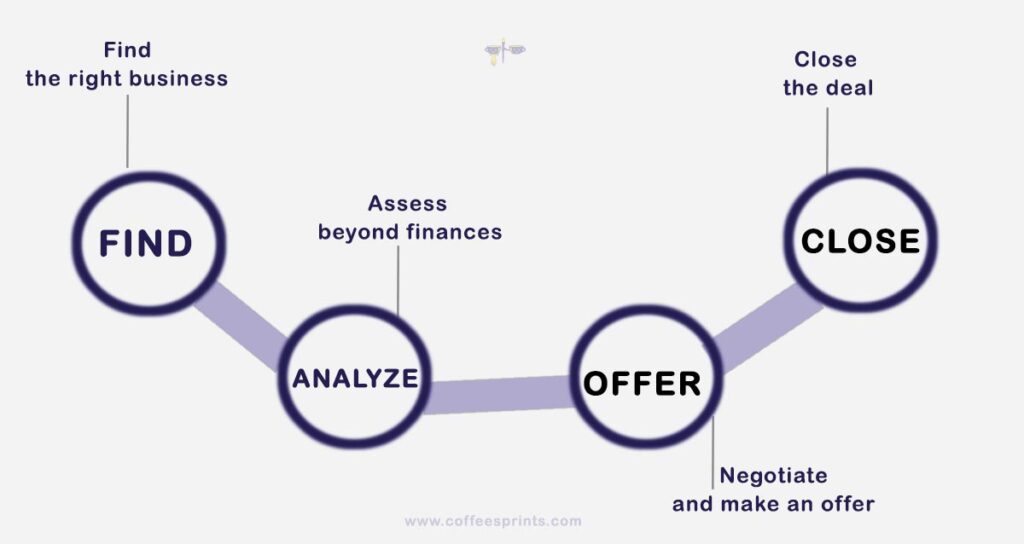

How to Buy a Business

This image helps you get an overview of the steps for buying an existing business.

Find the right business

So, when you’re thinking about buying a business, it’s important to narrow down what really gets you excited. What are your passions, interests, skills, and experience?

You’ll be a whole lot happier if you buy a business that aligns with what you already love and know a thing or two about.

Maybe you’ve been working as an employee at a company that’s now up for sale. Wouldn’t you be the perfect fit to buy that business? You know it like the back of your hand. You’ve seen it grow and evolve. You’ve got the inside scoop that no outsider can match. It’s like being the superhero who swoops in to save the day.

Buying a business for the financials can be tempting. But it’s also crucial to connect with the soul of the business. The more you know about the business’s model, products or services, customers, industry, and trends, the more you can bring in fresh and innovative ideas.

So when you’re on the hunt for a business to buy, remember to follow your heart and your gut. Find something that makes you jump out of bed in the morning. Look for that sweet spot where your skills, experience, and passion collide. Because that’s where the magic happens.

History and background of the business and its founders

How long has the business been around for? Who are the original owners? What was their expertise? Why did some of them leave?

These are the fundamental questions you should know before buying the business

Industry and business growth

Let’s say you’re going to buy a pet food business. Before you decide to buy one, you should know the scope of the growth in the pet food industry and the role and growing share of the specific business you want to buy.

What’s the owners’ reason(s) to sell the business?

In general, there’d be several reasons for a business to be sold. When you meet the owners, you should ask and get the right answers and reasons for why the company is being sold.

It’s easy to be misled and defrauded, so get the ability to analyze the market, judge the competition, and estimate the profits.

What’s their plan?

Understand the owner’s plans after selling the business. It is indeed crucial before making a purchase. You should know if they’re going to retire, start new ventures in a different business, pursue their interests, take a career break, or more.

It’s good to know their intentions and ensure transparent communication. Understand their plans and negotiate any necessary agreements or arrangements related to their post-sale involvement, non-compete clauses, or transition support.

Analyze – Conduct Due Diligence

Next up, conduct your due diligence, which takes the most time in your buying process. For the best results, we suggest taking the help of professionals.

As part of due diligence, the seller gives you access to the crucial documents and contracts that belong to them. You’d also need to sign an NDA (Non-Disclosure Agreement) to protect the confidentiality of the information.

Here are the details.

Finances

Here are the things you should check while looking into the financials of the business.

- Check the firm’s financial statements for the last 3-5 years

- Tax returns for the past five years

- Understand whether the company revenue and profits are rising or declining over time. If declining, get the reasons for it.

- Evaluate month-on-month sales for the past 2-3 years

- Firm’s operating ratios vs. the industry average – This helps you identify whether the operational costs of this business are higher or if they need to be looked into.

- Inspect bank deposits for at least five years or as long as the present owner operates

- Sometimes, when companies operate with low profits, they tend to cut into labor expenses. As you explore the finances, check the number of employees the company has employed and maintenance on equipment, building, or other expenses.

- Check whether the company has sufficient working capital or not.

- Ensure the company/owners have good relations with their bank

- Look for liabilities

- List of accounts receivable, breaking them by last 30 days, 60 days, 90+ days, etc.

- List of accounts payable as they could impact the cash flow

Additional Due Diligence you should conduct

Legal and Regulatory:

- Review contracts, agreements, and legal documents.

- Identify any ongoing or potential legal disputes.

- Evaluate compliance with industry regulations and licensing requirements.

- Assess the intellectual property rights and any potential infringements.

Operational Due Diligence:

- Understand the day-to-day operations of the business.

- Assess the efficiency of processes and systems.

- Review inventory management and supply chain logistics.

- Evaluate key operational assets, such as equipment and technology.

Customer and Market Due Diligence:

- Analyze the customer base, including customer acquisition and retention rates.

- Assess market demand and competition.

- Understand the business’s marketing and sales strategies.

- Evaluate the reputation and brand image of the business.

Employee and Human Resources Due Diligence:

- Review employee contracts, benefits, and compensation structure.

- Assess the skills and qualifications of key employees.

- Understand any labor-related issues or pending legal claims.

- Evaluate the organizational culture and employee morale.

Assets Due Diligence:

- Conduct a thorough inspection of the physical assets, including property, equipment, and inventory.

- Assess the condition and valuation of assets.

- Identify any environmental or regulatory issues related to the property.

Intellectual Property Due Diligence:

- Identify and assess intellectual property assets such as patents, trademarks, copyrights, and trade secrets.

- Verify the ownership and validity of intellectual property rights.

- Evaluate any licensing agreements or restrictions.

Tax Due Diligence:

- Review tax returns and assess potential tax liabilities.

- Evaluate any outstanding tax issues or audits.

- Consider the tax implications of the business acquisition structure.

Risk Assessment:

- Identify potential risks and vulnerabilities.

- Assess insurance coverage and liabilities.

- Consider industry-specific risks and external factors affecting the business.

Professional Advice:

- Engage legal, financial, and tax experts for comprehensive due diligence.

- Seek advice from industry consultants or specialists, if necessary.

- Obtain third-party appraisals or valuations of assets and business worth.

Remember, this checklist is a starting point, and it’s essential to tailor it to the specific circumstances of the business you are considering acquiring. Professional guidance and expertise are crucial to ensure a thorough due diligence process and minimize risks.

Negotiating the offer before buying the business

Now that you have all the information you need, you should prepare to negotiate the offer.

Mastering negotiation takes hard work, time, skill, and practice. It’s not impossible, though.

Before you negotiate, keep these 5 points in mind.

- Be Willing to Walk Away: While you should approach negotiations in a collaborative manner, it’s essential to maintain a certain level of detachment. Be prepared to walk away if the terms or conditions do not align with your objectives or if the business does not meet your criteria. This mindset demonstrates that you are serious about the negotiation and can lead to more favorable outcomes.

- Keep Emotions in Check: When buying a business, it’s crucial to keep emotions in check and approach the negotiation process with a level-headed mindset. While finding the right business can be exciting, it’s important to maintain a practical and analytical approach. Remind yourself that this is a significant, life-changing decision.

- Seek Advice if Needed: Seek advice from professionals, such as lawyers or business brokers, who can provide objective guidance and represent your interests. Their expertise can help avoid confusion and emotional aspects of the negotiation process, allowing for more rational and strategic decision-making.

- Leverage Timing and Alternatives: Understand the time pressures and alternatives available to both you and the seller. If the seller is motivated to sell quickly or has limited alternative options, you may have more leverage in the negotiation process. Conversely, if you have a strong desire to acquire the business or limited alternatives, the seller may hold a stronger position. Being aware of these dynamics can help you strategically navigate the negotiation process and find mutually beneficial terms.

- Price isn’t the Sole Factor: Price is important, but it’s not the only factor in buying or selling a company. Consider other terms such as stake transfer, control, first refusal, recourse, and seller financing. By understanding each other’s priorities, concessions can be made to keep the deal on track. For example, the seller may accept an earn-out if the buyer offers a higher price. Don’t fixate on price alone; explore various terms to reach a mutually beneficial agreement.

Remember, negotiation is a dynamic process, and flexibility is key. Adapt your strategies based on the specific circumstances, priorities, and personalities involved. Employ these strategies to increase the likelihood of achieving a successful outcome while buying a business.

Funding

If you have personal savings or access to funds, you can use your own money to finance the purchase. This option avoids interest or repayment obligations, but it may limit your available capital for other purposes.

However, if you’re not ready to invest with your own funds, you can look for financing options like

Traditional Bank Loans: Banks and financial institutions offer business loans specifically designed for acquiring existing businesses. These loans typically require collateral, a solid business plan, and a good credit history. The terms and interest rates will vary based on your financial situation and the lender’s criteria.

Small Business Administration (SBA) Loans: The U.S. Small Business Administration offers loans that are specifically tailored to assist small businesses, including those looking to acquire an existing business. SBA loans often have favorable terms and lower down payment requirements, but they may involve a longer application process and more stringent eligibility criteria.

Asset-Based Loans: If the business being acquired has significant tangible assets, such as equipment, inventory, or real estate, you may be able to secure an asset-based loan using those assets as collateral.

You can find all the information you need to fund your business here.

Closing the deal – The last step

If there are no surprises in the previous steps, your next step is to close the deal. You’ll need to carefully review all closing documents, including the bill of sale, transfer of assets, lease agreements, employment contracts, and any other relevant agreements. Verify that they accurately reflect the terms agreed upon and protect your interests.

Set a closing date and coordinate with all parties involved, including the seller, attorneys, lenders, and professionals, to finalize the transaction. Arrange for the transfer of funds, execute the necessary documents, and complete any post-closing requirements.

Once the deal is closed, focus on effectively transitioning into the role of the new business owner. Develop a comprehensive transition plan, communicate with employees and stakeholders, and implement any necessary changes to align the business with your vision and strategy.

Buying an existing business with no money

Here’s how you can consider buying an existing business with no money.

Look at different financial aspects and loans that you can avail

- The first thing you need to do is assess whether you can get a loan for the business.

- Dig into the company financials for this and understand the company’s financial statements. Talk to the people who know the business.

- Once you understand the business’s worth, you can explore your financing options.

Seek investments

If you have no funds but still want to buy a business, you should research and identify potential investors who may be interested in supporting your business acquisition. This can include angel investors, venture capitalists, private equity firms, or even friends and family members who believe in your entrepreneurial abilities.

Recommended Guide: Top Investment Ideas in 2023.

Work for Equity

It’s a simple concept where you work in the company and make yourself familiar with the work environment, employees, and customers.

In exchange for working for the business, the owners offer you equity, which can be a win-win for both parties. This way you can be in the game way before you actually explore buying it yourself. As the business grows and improves its profits, you can buy more shares and be the owner one day.

Reach out to people

If you have a network of people who are into businesses, you can reach out to them through email, phone, or social media. When someone within their community is going to sell a business, they would have you in mind or could help you with a deal.

Monitor business listing platforms

To increase your chances of finding what you need, be proactive in exploring various avenues. Start by exploring marketplaces such as BizBuySell and BizBen, which are good starting points. Dedicate some time to browse these platforms and save/bookmark the businesses that catch your interest.

Advantages and Disadvantages of Buying a Business

The prospects of buying a business can be appealing for many reasons. However, there could be some potential limitations that you should keep in mind before starting out. So we have compiled a list of potential advantages and disadvantages of buying an existing business.

| Advantages | Disadvantages |

|---|---|

| Existing customer base and reputation | High initial investment and financial risk |

| Established products or services | Potential for hidden liabilities or debts |

| Immediate cash flow | Operational and management challenges |

| Trained and experienced employees | Market or industry fluctuations |

| Established suppliers and vendors | Limited control over the business's history |

| Proven business model | Potential for legal or regulatory challenges |

| Brand recognition and goodwill | Dependence on the previous owner's expertise |

| Potential for growth and expansion | Possible resistance to change from employees |

While this is a broad-level view, the pros and cons of buying the business can vary depending on the type of business you’re buying. So ensure you conduct a thorough audit before buying.

To sum it up!

You might have already understood that buying a business is an exciting but complex endeavor. It can get pretty technical and vary depending on the nature of the business. If needed, work closely with experts to ensure a smooth and successful closing, setting the stage for your journey as a business owner.

Do you find this article helpful? Let us know your thoughts about this topic in the comments below. We’d love to hear from you!

2 thoughts on “The Entrepreneur’s Playbook: A Comprehensive Guide to Buying a Business”

Hi, Your article was beneficial.

Thank you for being so supportive and insightful!!